posted 17th October 2023

From 2013 to H1-2023 there have been 5,899 exits by high-growth companies, and a huge 96.3% of these exits took the form of acquisitions. The remaining 3.71% of exits were Initial Public Offerings (IPOs).

Recent exit activity in the market can largely be attributed to the economic stimulus measures implemented by the government to ease the impact of the COVID-19 pandemic, but what else is shaping the landscape of IPOs and acquisitions in the UK? GS Verde explores the various factors here.

Low Interest Rates and An Ageing Population Are Main Drivers of Business Exits

Established high-growth companies saw exits increase more than twofold between 2020 and 2021, thanks to low interest rates and quantitative easing. Despite rising interest rates and inflation, the exit market stayed strong in 2022.

Increasing business exits can also be attributed to the ageing population of business owners. There are 756,000 active companies in the UK where half of the company’s directors are over the age of 60. Despite the initial figures for the first half of 2023 suggesting that exits will return to pre-pandemic levels, these older business owners retiring may keep the exit numbers afloat.

Drop in IPOs in 2022 and 2023

The UK saw an increase in IPOs in 2021, with 55 high-growth companies choosing to float on the public markets for a total market capitalization of £20.9 billion. This is for a couple of reasons: the Covid-19 stimulus measures we mentioned earlier, and the rise of retail traders, enfranchised by user-friendly trading platforms.

But as economic conditions have declined, so has IPO activity decreased in 2022 and the first half of 2023. In fact, there has only been one IPO by a high-growth UK company in 2023 (so far), and that was the renewable fuel supplier ReFuels.

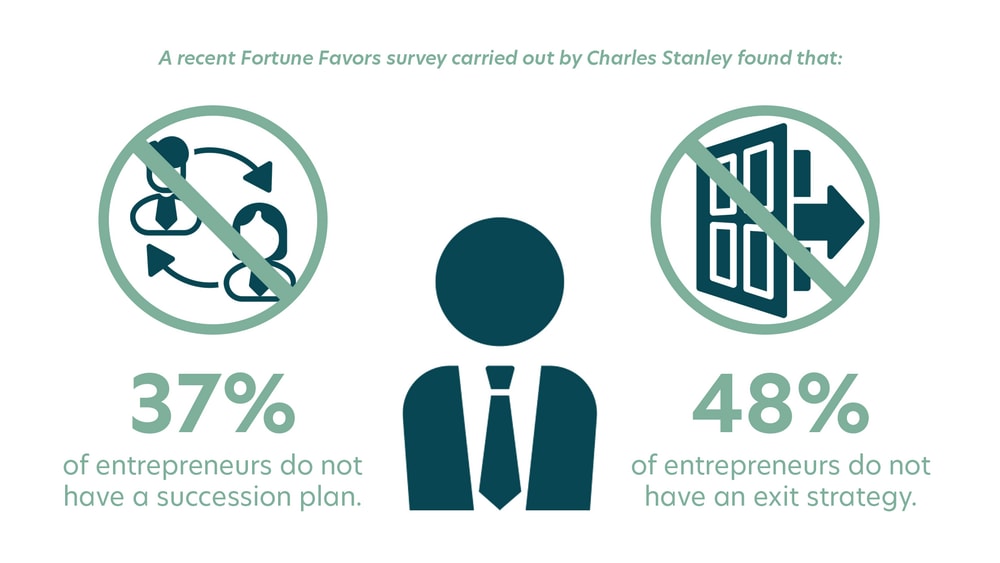

48% Of Entrepreneurs Do Not Have an Exit Strategy

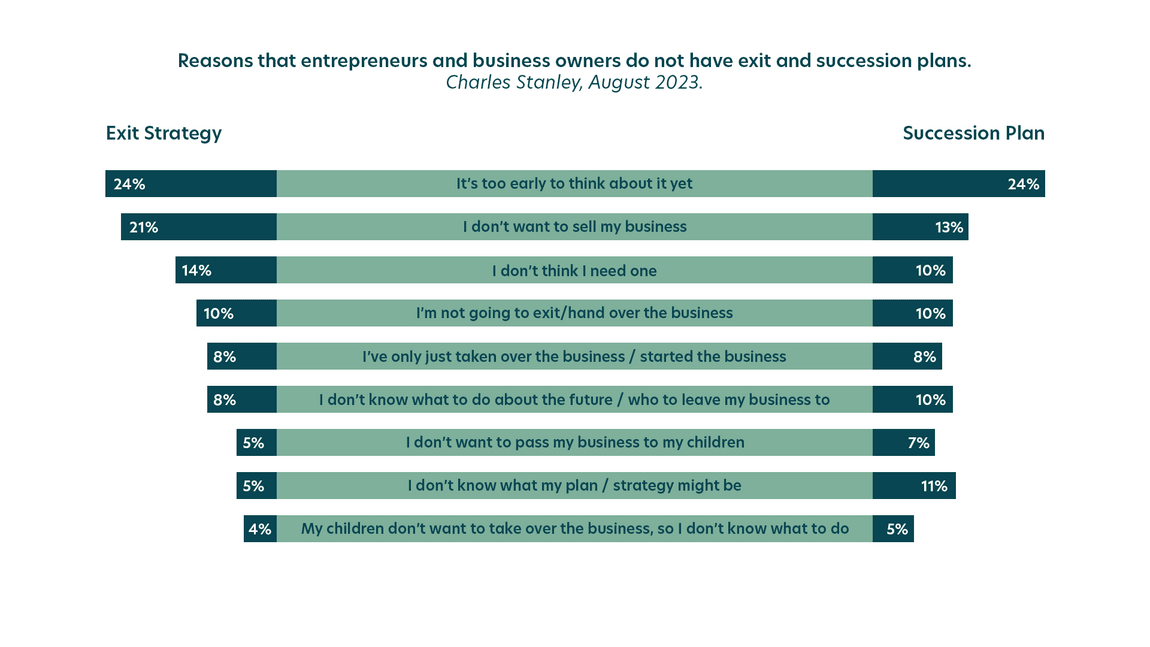

A recent Fortune Favours survey carried out by Charles Stanley found that 48% of the entrepreneurs they surveyed do not have an exit strategy for their business, while 37% have no succession plan in place.

Exploring the reasons why, 24% thought such planning would be premature for their businesses, but still 41% wanted to retire from their business roles in the next 10 years. There are a few factors underpinning this disconnect. While 21% resisted the idea of selling altogether, 14% of business owners felt that exit strategies were unnecessary while 10% felt the same way about succession plans.

Other concerns that made entrepreneurs hesitant about exit and succession planning were seeing their business fail (21%), the valuation of their businesses being downgraded in the current environment (20%), and employee welfare being affected (18%).

Corporate Buyers More Likely to Acquire Businesses Than Financial Buyers

Corporate buyers have become the most common acquirers of high-growth companies in the UK, more so than financial institutions. This trend reflects strategic acquisitions by businesses looking to broaden their market presence, provide more varied service offerings, or gain a competitive edge by acquiring innovative businesses.

Once again, 2021 saw the number of acquisitions by both corporate and financial buyers reach its peak, reflecting the figures from 2020. Although these figures have dipped recently, they may still exceed pre-pandemic levels.

2021 was an excellent year for acquisitions and IPOs, reflecting increased exit activity from all company stages, but particularly from established businesses. Although 2022 saw high acquisition activity, the data from the first half of 2023 indicates that acquisition numbers will most likely return to pre-pandemic levels.

The data shows that while exit activity has slowed since 2021 and 2022, companies are still utilising acquisition as an exit method at similar levels to 2018 and 2019.

However, public markets paint a different picture, with IPO activity for high-growth companies at a decade low.

While trends in the exit market change due to macroeconomic factors, it will always be vital to have a succession plan or exit strategy in place, and acquisition can be an effective strategy for encouraging growth.

GS Verde Group can assist on every aspect of both types of business transaction, from structuring deals to carrying out due diligence. Our multidiscipline team combines corporate finance, law, tax, and communications support for a streamlined, end-to-end service.

To learn more about how we can support you through the M&A process, visit our Sell A Business page or Share Your Acquisition Criteria with us today.

Source: Beauhurst